#Fibonacci breakout confluence

Explore tagged Tumblr posts

Text

How to Trade the Breakout & Retest Pattern: Strategies That Work

Breakout and retest trading is one of the most reliable techniques in technical analysis. It allows traders to enter trades with confidence after confirming the breakout of a key support or resistance level. If executed correctly, it offers high probability entries, clear invalidation points, and strong risk-to-reward ratios. In this blog, we’ll break down everything you need to know about the…

#breakout and pullback strategy#breakout and retest confirmation#breakout and retest pattern#breakout and retest trading strategy#breakout continuation pattern#breakout entry strategy#breakout retest candlestick pattern#breakout reversal signals#breakout trading risk management#breakout trading strategy for beginners#breakout vs breakdown#chart patterns with breakout#Confluence Trading#failed breakout recovery#fake breakout vs real breakout#Fibonacci breakout confluence#high probability breakout setup#how to identify breakout levels#how to trade breakout and retest#intraday breakout and retest setup#key support and resistance zones#learn technical analysis#Price Action Trading#retest after breakout#retest in technical analysis#stock markets#stock trading#successful trading#support and resistance breakout#swing trading breakout strategy

0 notes

Text

Liquidity Sweep Analysis: How Smart Money Controls Price Moves

Liquidity is one of the key pillars of the financial markets. It enables traders to buy and sell assets quickly without causing major price changes.

But there's more to liquidity than just ease of trade. When big players in the market manipulate liquidity, it can have a significant impact on retail traders. This market behavior is known as a liquidity sweep—and if you’re trading without understanding it, you might be at a serious disadvantage.

Not sure what a liquidity sweep is or how it works? Don’t worry. In this guide, we’ll explain everything you need to know about identifying and trading liquidity sweeps like a pro.

What is Liquidity and a Liquidity Sweep?

Liquidity refers to how easily an asset can be bought or sold at a stable price. A highly liquid market has strong trading volume, making it easy to enter or exit trades. On the other hand, low liquidity leads to less efficient trading and higher volatility.

Several factors affect liquidity, but one major influence is the activity of smart money—large institutional traders, banks, and hedge funds. When these players execute big trades, they shift market volume, creating conditions ripe for liquidity sweeps.

A liquidity sweep happens when these major players push prices beyond key support or resistance zones to trigger stop-loss orders or pending trades from retail participants. Once these orders are activated and liquidity is collected, prices often reverse—catching smaller traders off guard.

Why Liquidity Sweeps Matter

Liquidity sweeps are a common tactic used to trap unsuspecting traders. As prices temporarily break support or resistance zones, retail traders may enter or exit too early, only to see the market reverse direction shortly after.

These sweeps make market prediction tricky and can lead to false breakouts, slippage, and even stop-outs if you're not paying attention. That’s why understanding this pattern is essential for every serious trader.

How to Identify Liquidity Sweeps in the Market

1. Look for Sudden Highs and Lows

Liquidity sweeps often show up as sharp price spikes or drops that form new highs or lows on the chart. These moves are often reversed quickly, tricking traders into thinking a breakout is in play.

2. Spot Fake Breakouts

Watch out for strong candle patterns or sudden breakouts that fail to hold. When price breaks a level but quickly reverses and rejects it, it’s often a sign that large players are collecting liquidity and manipulating price.

3. Observe Key Support and Resistance Levels

Liquidity sweeps typically occur around major support and resistance areas. Monitor these zones carefully and track how price behaves when it crosses or touches them.

4. Use Volume for Confirmation

Volume and liquidity go hand in hand. An increase in volume during a sudden price move may indicate that smart money is involved. When volume spikes align with a sharp reversal, a liquidity sweep is likely underway.

5. Monitor Fibonacci Retracement Zones

Liquidity sweeps often occur near critical Fibonacci retracement levels, especially the 61.8% mark. Watch how price reacts at these levels—they are often prime zones for traps and reversals.

Tips for Trading Liquidity Sweeps

1. Track Important News and Events

Liquidity sweeps are common during major economic announcements and political events. These moments bring high volatility and provide ideal conditions for market makers to execute sweeps. Stay updated with the economic calendar.

2. Use Higher Time Frames

Short-term charts (5m, 15m, 1h, 4h) can be noisy and misleading. Liquidity sweeps are easier to identify on longer time frames such as daily, weekly, or monthly charts, where price structure is clearer.

3. Wait for Confirmation

Don’t rush into trades immediately after spotting a sweep. Confirm the move by checking volume levels, price action at key zones, and Fibonacci confluence. A patient, data-backed entry is more reliable than a reactive one.

4. Trade During High-Volume Sessions

Liquidity sweeps are most common during peak trading hours. In forex, this means the London and New York sessions. For stocks, focus on the market open and close. These sessions offer more reliable setups.

5. Apply a Risk-Reward Strategy

Sweeps can be volatile and unpredictable. Always define your risk-to-reward ratio before entering a trade. This ensures you protect your capital and maintain consistent profitability.

6. Follow the Smart Money

Liquidity sweeps are engineered by market makers. Study their behavior—how they position, how price reacts after key zones are hit, and what happens to volume. Learning to read smart money movements gives you a significant edge.

Final Thoughts

Liquidity sweeps can disrupt trading plans and trigger unexpected losses for retail traders. But rather than fearing them, it’s better to understand and use them to your advantage.

With the right strategy, you can learn to recognize these patterns, avoid traps, and even capitalize on the volatility they create. Keep an eye on volume, major price zones, and trading sessions—these clues will help you spot sweeps early and trade them with confidence.

The market is shaped by those who understand how it really works. Master liquidity sweep trading, and you'll put yourself one step ahead of the competition.

0 notes

Text

Bitcoin’s Future: How On-Chain Indicators and ETF Inflows Fuel Hope

Key Points

Bitcoin’s price bounce back and ETF inflows indicate a bullish market outlook.

On-chain indicators, including mean age of investment and MVRV ratio, signal room for growth.

The cryptocurrency market has recently seen liquidation surpassing $500 million in the last 24 hours. Despite this, Bitcoin’s price has shown resilience, hitting a low of $94,306 before bouncing back to a market price of $97,727.

This recovery in Bitcoin’s price coincides with a surge in institutional demand, undermining the short-term correction and indicating a bullish market outlook.

US Spot ETFs Attracting Significant Inflows

US spot Bitcoin ETFs have seen a daily total net inflow of nearly $440 million, indicating a race among institutions to accumulate Bitcoin.

BlackRock led the institutional investments with a $295.63 million inflow, followed by Fidelity with $210.48 million worth of Bitcoin accumulated over the last 24 hours.

This has resulted in the total net assets of US spot ETFs reaching $107.76 billion, or 5.65% of Bitcoin’s market cap. Out of 12 registered Bitcoin ETFs, five recorded a net positive flow, three recorded a net outflow, leaving four ETFs with a net zero flow.

As Bitcoin’s recovery gains momentum, on-chain indicators are starting to flash a buy signal.

Mean Age of Investment Indicates Market Recovery

One of the less-discussed metrics in crypto, the mean dollar invested age, supports this buy signal as the market gradually recovers from the recent retracement.

Based on the on-chain indicator, the mean age of Bitcoin investments has decreased to 439 days. This translates to a 31% younger mean age over the past 60 weeks.

Similarly, for XRP, the mean age of investment has decreased to 865 days, making it 22% younger over the past 14 weeks. Meanwhile, Dogecoin’s mean investment age has dropped to 370 days, making it 31% younger over the past eight weeks.

The mean dollar age invested line drops for Bitcoin, and the top altcoins signal that the older and stagnant wallets are circulating the dominant coins. This circulation, coming from large key stakeholders or whales, marks a healthy signal for the bull run.

The mean age of investment is a critical indicator that has proved its mettle in the 2017 and 2021 bull markets. In the previous bull runs, the markets peaked and started going down when the mean ages started increasing or getting older again.

Therefore, despite the short-term price fluctuations in Bitcoin and the top altcoins, the decrease in the mean age of investment signals a medium to long-term bullish market.

MVRV Ratio Suggests Room for Growth

Another key on-chain indicator for predicting the peak of the bull market is the market-value-to-realized-value ratio. This is the market cap ratio to each address’s average purchasing cost.

Currently, the MVRV ratio stands at 2.55 compared to the 2021 bull run peak of 3.68. In the 2017 bull run, the MVRV ratio peaked at 4.24 and 4.91 in 2013.

As the MVRV ratio continues to fall during consecutive bull runs’ peak, it remains a crucial signal for predicting bullish exhaustion. At 2.55, the on-chain indicator signals room for growth.

Bitcoin Targets New All-time High

As Bitcoin’s price bounces from the crucial support of $94,425, it marks a V-shaped recovery to challenge the short-term resistance trendline. The recovery rally has surpassed the 50 SMA line in the 1-hour chart.

Further, it tests the resistance confluence of the 38.20% Fibonacci level at $97,945 and the resistance trendline. The short-term pullback has resulted in a death cross in the early time frame and warns of a bearish crossover between the 200 and 100 SMA line.

As the recovery rally gains momentum with the rising ETF inflows, the chances of a breakout rally have fundamentally increased. However, Bitcoin’s price action showcases the formation of low-range price candles as they reach the resistance zone.

This warns of another potential pullback to retest the 23.60% Fibonacci level at $96,600. Nevertheless, with the on-shell indicator signaling a bullish run ahead, the breakout of the local support trendline will provide a buying spot point for price action traders.

With this breakout rally, the Fibonacci levels paint significant resistance at the 61.80% Fibonacci level near the $100,000 psychological mark. Closing above this will increase the chances of Bitcoin reaching the $103,647 mark, potentially creating a new all-time high.

Based on the Fibonacci levels, the price targets for a new all-time high are $106,145 and $109,333.

In summary, with the intraday recovery and on-chain signals, the bull run in Bitcoin shows the potential to sustain the minor hiccup.

0 notes

Text

Mastering Trend Channels: The Trader’s Blueprint to Navigating Market Waves

📈 What Exactly Are Trend Channels and Why Do Smart Traders Swear by Them?

Trend channels are the backbone of price action trading. Think of them as a trader’s visual map—guiding entry, exit, and risk management decisions. A trend channel consists of two parallel lines that confine price movement. The upper boundary acts as resistance, the lower as support.

💬 John J. Murphy, author of Technical Analysis of the Financial Markets, emphasizes channels as a cornerstone of trend identification.

In the Indian stock market, trend channels helped traders ride massive moves in Reliance Industries between 2020–2022, where prices bounced cleanly within an ascending channel before a breakout above ₹2700.

🔍 Building the Skeleton: What Forms a Trend Channel?

At its core, a trend channel is drawn by connecting swing highs and swing lows with parallel lines. These can be:

🔹 Ascending channels – bullish markets 🔹 Descending channels – bearish environments 🔹 Horizontal channels – ranging or sideways trends

Platforms like Strike Money, TradingView allow traders to effortlessly draw these channels. On Nifty 50, a descending channel between October–December 2023 guided several short opportunities before the market reversed.

🚀 Types of Trend Channels You Need to Master Now

💥 Ascending Channels – These slope upward. They often appear during bull runs. A great example? Tata Motors (2021–2022), where traders who rode the lower band support saw gains as it touched ₹520 from ₹300.

💥 Descending Channels – Common in bear phases. Zomato Ltd in mid-2022 presented a textbook descending channel before it broke out around ₹65, offering a reversal signal.

💥 Horizontal Channels – Sideways markets can be frustrating but profitable. HDFC Bank traded in a horizontal channel between ₹1400–₹1500 for several months in 2023, ideal for range-based trades.

🛠️ Drawing Trend Channels: The Right Way Using Strike Money

Many traders fail because they draw channels emotionally, not logically. Here’s the pro way:

✨ Use Strike Money to spot significant swing points ✨ Connect at least two highs and two lows ✨ Extend the lines forward ✨ Ensure the channel’s midpoint often aligns with price pivots

Pro Tip: Use Fibonacci retracement in conjunction with channel bounds. A common confluence on Nifty IT was a 38.2% retracement lining up with the lower channel line in March 2023—signaling a solid long entry.

💡 High-Conviction Channel Trading Strategies That Actually Work

📌 Buy at Lower Channel Support, Sell at Upper Resistance 💥 Example: ICICI Bank moved in a clean upward channel from ₹700 to ₹920 in early 2024. Traders who bought near the lower band and exited near the top made consistent returns.

📌 Breakout Strategy 💥 Infosys broke out of a long-term descending channel in January 2023 at ₹1350, rallying swiftly to ₹1600—validating a breakout strategy.

📌 Channel + RSI Divergence 💥 RSI confirming a bullish divergence at channel support is golden. In Maruti Suzuki (2023), RSI diverged upward while price touched the lower channel. Outcome? A sharp reversal.

⚠️ Breakouts, Fakeouts, and What Institutions Know That You Don’t

Breakouts aren’t always what they seem.

💣 In 2022, Adani Enterprises appeared to break below a horizontal channel at ₹1450. Panic selling followed—but within days, it bounced back inside the range, trapping bears. That’s a false breakout.

🔍 Institutions often use volume spikes to differentiate real vs. fake breakouts. No volume = likely trap.

🧠 Dow Theory suggests that price must confirm with volume. So when Infosys broke above its long-term descending channel in January 2023, the accompanying volume validated it.

🧰 Charting Tools and Resources to Master Channel Trading

Want an edge?

✨ Strike Money – Seamless channel drawing and backtesting ✨ TradingView – Great for community-shared channel ideas ✨ Investopedia – For conceptual clarity ✨ CMT Association – Get certified and go pro

💼 CME Group also provides insightful derivatives data, enhancing trend confirmation for professional traders.

🧠 How Hedge Funds and Big Money Use Trend Channels Differently

Institutions don’t just draw lines. They combine trend channels with:

🔍 Order flow analysis 🧩 Algorithmic signals 📊 Correlation to macro data

📘 A 2021 CFA Institute study revealed that proprietary trading desks at major funds incorporate price channeling with machine learning algorithms for predictive modeling.

🔥 Hedge funds in India use channel-based pairs trading strategies in Bank Nifty vs. Nifty Futures, exploiting correlation channels over time.

🤯 The Top Mistakes Traders Make with Trend Channels (And How to Dodge Them)

❌ Drawing channels on minor timeframes – Leads to noise ❌ Ignoring volume or confirmations – Misses false breakouts ❌ Forcing a channel to fit the price – Confirmation bias ❌ Skipping the midpoint analysis – Misses structure insights

🔥 In 2023, many traders forced an ascending channel on Yes Bank, only to get trapped in a breakdown. Avoid drawing with hope—draw with precision.

🔮 Are Trend Channels Still Relevant in 2025 and Beyond?

With the rise of AI in trading and algorithmic strategies, some argue traditional charting is obsolete. But data says otherwise.

📊 Strike Money’s Q1 2025 research shows that channels still provide a 63% win-rate when used with confirmation tools like RSI and volume.

As market sentiment becomes more data-driven, visual patterns like trend channels remain psychologically anchored. Markets change, but human behavior—fear and greed—remains constant.

✅ Final Word: Trade with Clarity, Not Noise

Trend channels aren’t magic. But when understood deeply, used wisely, and confirmed smartly, they give traders a clear edge in uncertain markets. Whether you’re trading Reliance, Nifty, or ITC, remember this:

🔗 The market always leaves clues. Channels help you connect them.

Looking to sharpen your charting edge? Start drawing smarter with Strike Money and see the market like a pro.

Want me to turn this into a downloadable PDF or lead magnet?

0 notes

Text

Polygon (MATIC) is wobbling in a murky technical environment, down 4.2% to $0.557 on Friday. The leading Ethereum Layer 2 scaling protocol has ignored sentiments around the development of a major upgrade, Polygon 2.0. From a long-term perspective, a rebound is brewing, however, short-term analysis reveals the possibility of another sweep at lower support areas – tentatively $0.54 and $0.493, respectively. Polygon 2.0 Update – MATIC Price Drops Polygon developers published another significant update on X (formerly Twitter) regarding the impending launch of the protocol’s upgrade, Polygon 2.0. According to the announcement, POL contracts are set to go live on the Goerli testnet, marking “a major step towards bringing Polygon 2.0 to life.” Today, as a result of community consultations, POL contracts will be live on Goerli testnet. A major step towards bringing Polygon 2.0 to life. Based on the community’s feedback during the PIP governance process, PIP-24: Change EIP-1559 Policy & PIP-25: Adjust POL Total Supply,… pic.twitter.com/li8OF0o3jC — Polygon Devs 📍 DevX Global Tour (@0xPolygonDevs) October 4, 2023 After reviewing feedback from the community, developers set the total supply of POL, the token expected to power the ecosystem on the new protocol. The development team said that this step is significant to the “EIP-1559 burn system needed for Phase 0 of Polygon 2.0.” “In the coming weeks, the first steps of the new proposed governance for Polygon 2.0 will be shared, the core of which will be a new Ecosystem Council composed of thought leaders and technology experts; pillars of the Web3 community with substantial security credentials,” Polygon developers said via X. The community has been requested to stay tuned for more updates, especially on the POL testnet as the development team strives to “build the value layer of the internet.” On the other hand, MATIC price is holding slightly above support provided by the 21-day Exponential Moving Average (EMA) (red) after bulls were rejected from resistance highlighted by the 23.6% Fibonacci retracement level which coincidently forms a confluence with the falling trendline. MATIC/USD daily chart | Tradingview The Relative Strength Index (RSI) reinforces the bearish outlook as the uptrend weakens paving the way for a pullback. Support at the 21-week EMA must hold, otherwise, Polygon might drop to $0.493 in search of support. Despite the glaring bearish outlook, there is still hope for a Polygon price recovery based on the falling wedge pattern on the same daily chart. As a reversal pattern, the wedge forms toward the end of a downtrend. A breakout would be expected if MATIC price obliterates resistance at the falling trendline – backed by a significant increase in trading volume. It is recommended to place buy orders above the wedge pattern amid expectations of a run up to $1.

0 notes

Text

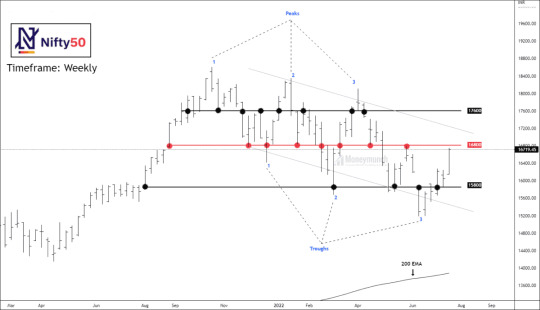

New Post has been published on Moneymunch

New Post has been published on https://moneymunch.com/nifty-outlook-multiple-time-frame-analysis/

NIFTY Outlook - Multiple Time-frame Analysis

[vc_row][vc_column][vc_column_text][/vc_column_text][vc_empty_space height=”20px”][vc_column_text]Weekly overview: The previous week’s closing price was strong enough to let traders think about a bull market, But is it the right time to be a bull trader?

As you can see in the chart, we are getting some price levels very often, such as 15800, 16800 & 17600. It is the perfect example of the assumption of technical analysis, “History tends to repeat itself.” Nifty has given eight touches at 16800, nine touches at 16600, and finally five touches at 15800.

Currently, the price is marching towards 16800, which is the resistance for now to the nifty. If you notice like a hawk, there will be a conclusion that prices have reached 17600 after the breakout of 16800. Let’s analyze and gather some clues from the lower time frame charts, but don’t forget to keep the bigger picture in mind.[/vc_column_text][vc_empty_space height=”20px”][vc_column_text][/vc_column_text][vc_empty_space height=”20px”][vc_column_text]Daily Overview:

After analyzing the weekly chart, we have noted our levels. But prices don’t exactly fall from these levels. Indeed, 1 – 2% penetration is acceptable on the resistance.

There are 3 price confluences zones for nifty: 1) The price is marching for the upper band of the parallel channel at 16931. 2) 16989 is 61.8% Fibonacci retracement of the previous move. 3) Price has broken out 200 EMA.

The parallel channel is valid with 8 lower band touches, 14 control line touches, finally 3 upper and touched.[/vc_column_text][vc_empty_space height=”20px”][vc_column_text]Timeframe: Hourly

Lock

Only premium subscribers can read the full article. Please log in to read the entire text. If you don’t have a login yet, please subscribe now to get access.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column][/vc_row]

#free stock tips#Intraday Stock Tips#nifty future tips#nifty intraday tips#NIFTY TIPS#nifty today#nifty trading tips#share market tips#STOCK TIPS

0 notes

Text

Stock Trading Class

11.12.21/ 3011.12 Lesson 3 & 4 - Technical Analysis

12.12.21 Lesson 5 - Position Sizing

18.12.21 Lesson 6 & 7 - EMA Bounce Strategy & Psychology

19.12.21 Lesson 8 & 9 - Trading Plan & Charting/Broker Platform

22.12.21 Lesson 9 & 10 - Charting/Broker Platform (cont’d)

23.12.21/ 30.11.2022 Lesson 1 (Part 2) - Momentum Trend Trading -- Trend Retracement

24.12.21 Lesson 2 (Part 2) - Momentum Trend Trading -- Breakout System

25.12.21/ 1.12.22 Lesson 2, 3 & 4 (Part 2) - Breakout System (cont’d), Momentum Value Rotation, Anticipate Trend Reversals with Divergence

26.12.21 Lesson 5, 6 & 7 Trend Trading -- Bollinger Mean Reversion, Capitulation & Power of Confluence

28.12.21 Lesson 8 Trend Trading -- Gap Up News Scalp (GUNS) -- didnt complete

28.12.21/ 1.12.22 Lesson 9 Trend Trading -- Slingshot Trading System

NOTE: TO REPEAT Lesson 6 (part 1), Lesson 1 & 3 (Part 2), Fibonacci Retracement level (50% or 61.8%)!

1 note

·

View note

Text

Compound bulls were ecstatic after the recent gains It was possible that COMP could retrace a significant chunk of the recent rally- and buyers could hunt for the ideal entries Compound [COMP] noted double-digit percentage gains in the past 24 hours. The governance token dipped to $38.24 on 26 September but rallied to $50.28 by 28 September. This represented a 31.5% move northward in under two days. Read Compound’s [COMP] Price Prediction 2023-24 While it might be attractive to think that the bulls can drive prices higher, the more prudent course of action could be to wait for a retracement. How low would COMP be able to dip, and would such a scenario be a realistic expectation? The move was almost vertical, but COMP traders should beware of FOMO Source: COMP/USDT on TradingView The four-hour chart noted that the $42.92 was a local high that Compound registered on 16 September. Additionally, the cyan box represented a former bearish order block on the daily chart that reached from $40.68 to $44.44. When COMP breached the $42.9 and the $44.44 levels in recent hours, it showed bulls were in complete control of the market and that sentiment was euphoric. The move indicated bullish dominance and showed that COMP could easily push past the $50 level soon. Yet, before that, we could see a retest of the former bearish order block, now a bullish breaker block. This zone has confluence with a fair value gap on the H4 chart from $41.79 to $42.94, and a retest would offer an ideal buying opportunity. Another thing traders can watch out for is a rejection from near the $51.9 resistance. Over the next few days, such a rejection would enable traders to plot Fibonacci retracement levels for the rally and determine where they could look to enter go long. The Open Interest chart reflected intense bullish sentiment Source: Coinalyze The breakout past $44.44 was accompanied by a huge spike in the Open Interest. It surged from $25.5 million to $46 million. This gigantic leap was due to bullish speculators entering the market in droves indicating powerful bullish conviction. How much are 1, 10, or 100 COMP worth today? The spot Cumulative Volume Delta (CVD) also leaped higher and the funding rate was positive. Yet, it does not rule out the possibility of a retracement. Based on the price action, a drop to the $42-$44 region could present a good risk-to-reward buying opportunity targeting $51.9. Source

0 notes

Text

Ethereum declines to $234 following Bitcoin’s moves

Ethereum has sank to $234, following on from Bitcoin’s decline to $9,150 Ethereum continues to trade under $240, with the price of the second largest cryptocurrency moving in tandem with Bitcoin. Although the two coins are likely to continue their correlation, there’s a confluence of indicators that suggests an upswing for Ethereum is on the cards. According to one analyst on Twitter, bears have failed to take charge of momentum below $238. This lack of conviction means Ethereum could be in a mini accumulation phase that is likely to precede another upswing. Buyers will need to hold current prices, as shown on the lower time frames. An upward move to break resistance at $246 would see momentum take prices higher. Ethereum price ready for a breakout. Source: TwitterEthereum technical outlook Ethereum for the past seven days has traded sideways; on the cusp of a breakout helped by the lack of conviction by bears. Although Ethereum faces the risk of a downturn if sellers come out in force, the technical outlook suggests that stalling below $240 might actually help the bulls consulate before moving to higher prices. Bulls will need to beat bears at $239.52, which has offered the strongest resistance in the past week. It is at this level that multiple technical indicators have confluence: the Bollinger Bands widths one-hour, the shorter-term five-day simple moving average on the four hour chart. Also visible is the Fibonacci 38.2% retracement on the daily timeframe. Read the full article

0 notes

Text

Bitcoin Market “Fireworks” Are Dependent on This Critical Level Above $10k

The past few days have undoubtedly been bullish for Bitcoin, with the cryptocurrency ripping over 20% higher from the mid-$7,000s to a price as high as $9,500 over the course of 48 hours. This stunning rally has brought the cryptocurrency above some key resistance levels pointed out by traders. One trader noted that during the move, BTC passed the point at which bears made their “last stand,” marked by a confluence of resistance levels like the 200-day simple moving average and the 61.8% Fibonacci Retracement of the 2020 highs and lows of $10,500 and $3,700, respectively. Related Reading: Crucial Bearish Factor That Haunted Bitcoin Since $5ks Was Just Invalidated It’s too soon to be long-term bullish on Bitcoin, though, with a leading investor claiming that the crypto market remains in a macro range, not in a bull market as some investors have asserted. Bitcoin Needs to Eclipse $11,800 According to a prominent crypto trader, while the recent breakout has brought the cryptocurrency above a crucial resistance, Bitcoin is in a “ranging market until we close a weekly [candle] $11,800.” A close above this price point, he explained, will catalyze “real fireworks” for the BTC market. As can be seen in the chart below, $11,800 has been a critical inflection point for Bitcoin, with $11,800 marking the top of 2019’s rally on two occasions, and the top of a reversal rally in the 2018 bear market. Chart from @George1Trader (Twitter) Related Reading: A Top Crypto Trader is Selling His Altcoins Due to These “Red Flags” Can Price Do It? Although $11,800 is a whole 35% above the current market price of $8,800, there are signs that Bitcoin will start trending towards that critical level in the coming days ahead. Per previous reports from NewsBTC, Kelvin Koh — a former Goldman Sachs partner and current partner at The Spartan Group — wrote in a recent analysis that the resilience of digital businesses amid the coronavirus outbreak will be a decisive boon for crypto: “One thing was made clear during the pandemic. Digital businesses were clear winners in this crisis and a world scarred by it will accelerate towards digitization, which bodes well for crypto longer term,” the analyst wrote on the subject. Koh added that with central banks injecting trillions of dollars worth of stimulus into the economy, crypto stands to benefit. “Some of the trillions of dollars of stimulus from central banks will inevitably flow into crypto assets,” he explained. Technical indicators share an optimistic outlook. A trader found that Bitcoin has printed a series of bullish divergences. The divergences the trader pointed to were notable as he found a total of three on a weekly time frame: Bitcoin has trended lower as the Money Flow Index, the MACD, and the Fisher Transform indicators have pushed higher. Chart from @CryptoHamsterIO (Twitter) The imminence of the block reward halving could accelerate this bullish narrative, especially as investors continue to buy in anticipating the event. Photo by Ray Hennessy on Unsplash from Cryptocracken WP https://ift.tt/2VSUfIJ via IFTTT

0 notes

Text

Bitcoin Market “Fireworks” Are Dependent on This Critical Level Above $10k

The past few days have undoubtedly been bullish for Bitcoin, with the cryptocurrency ripping over 20% higher from the mid-$7,000s to a price as high as $9,500 over the course of 48 hours. This stunning rally has brought the cryptocurrency above some key resistance levels pointed out by traders. One trader noted that during the move, BTC passed the point at which bears made their “last stand,” marked by a confluence of resistance levels like the 200-day simple moving average and the 61.8% Fibonacci Retracement of the 2020 highs and lows of $10,500 and $3,700, respectively. Related Reading: Crucial Bearish Factor That Haunted Bitcoin Since $5ks Was Just Invalidated It’s too soon to be long-term bullish on Bitcoin, though, with a leading investor claiming that the crypto market remains in a macro range, not in a bull market as some investors have asserted. Bitcoin Needs to Eclipse $11,800 According to a prominent crypto trader, while the recent breakout has brought the cryptocurrency above a crucial resistance, Bitcoin is in a “ranging market until we close a weekly [candle] $11,800.” A close above this price point, he explained, will catalyze “real fireworks” for the BTC market. As can be seen in the chart below, $11,800 has been a critical inflection point for Bitcoin, with $11,800 marking the top of 2019’s rally on two occasions, and the top of a reversal rally in the 2018 bear market. Chart from @George1Trader (Twitter) Related Reading: A Top Crypto Trader is Selling His Altcoins Due to These “Red Flags” Can Price Do It? Although $11,800 is a whole 35% above the current market price of $8,800, there are signs that Bitcoin will start trending towards that critical level in the coming days ahead. Per previous reports from NewsBTC, Kelvin Koh — a former Goldman Sachs partner and current partner at The Spartan Group — wrote in a recent analysis that the resilience of digital businesses amid the coronavirus outbreak will be a decisive boon for crypto: “One thing was made clear during the pandemic. Digital businesses were clear winners in this crisis and a world scarred by it will accelerate towards digitization, which bodes well for crypto longer term,” the analyst wrote on the subject. Koh added that with central banks injecting trillions of dollars worth of stimulus into the economy, crypto stands to benefit. “Some of the trillions of dollars of stimulus from central banks will inevitably flow into crypto assets,” he explained. Technical indicators share an optimistic outlook. A trader found that Bitcoin has printed a series of bullish divergences. The divergences the trader pointed to were notable as he found a total of three on a weekly time frame: Bitcoin has trended lower as the Money Flow Index, the MACD, and the Fisher Transform indicators have pushed higher. Chart from @CryptoHamsterIO (Twitter) The imminence of the block reward halving could accelerate this bullish narrative, especially as investors continue to buy in anticipating the event. Photo by Ray Hennessy on Unsplash from CryptoCracken SMFeed https://ift.tt/2VSUfIJ via IFTTT

0 notes

Text

The Candlestick Trading Bible

New Post has been published on https://autotraffixpro.app/allenmendezsr/the-candlestick-trading-bible/

The Candlestick Trading Bible

Buy Now

In this Ebook You Will learn…

Candlestick Patterns

How to recognize the most important candlestick patterns in the market

The Market Structure

How to identify trending markets, ranging markets, and choppy markets.

Time Frames Analysis

How to analyze the market using the top down analysis approach

Trading Strategies

How to trade the market using four price action trading strategies

What the candlestick Trading Bible is All About?

The Candlestick Trading Bible was invented by the Japanese rice trader Munehisa Homma. He is considered to be the most successful trader in history.He was known as the god of markets in his day. His discovery made him more than $10 billion in today’s dollars trading the Japanese rice market.

Since I discovered this price action system, my life has been completely changed from that of a loser, to that of a successful father and trader.If you can take a little bit of your time to read what I am sharing with you today and if you apply it, I guarantee that you will make money trading in any financial market.

I can’t promise how long this page is going to be up and available, so please be sure to carefully read the entire strategy from the beginning all the way to the end–while it is still here.

I have spent 10 years–compiling, testing, organizing, and consistently updating this method to create my own new version, which is considered to be the easiest and most profitable trading system.You don’t need to spend an extra 10 years like I did to find a winning system, because I have shared everything I have discovered in my work.You don’t even need a Master’s degree in finance or to be some math whiz like Albert Einstein to be a profitable trader.Most successful traders are dropouts, and all you need is some common sense and the ability to act on what you know is true.

What You Need is a Simple, Easy, and Profitable Trading Strategy

My journey was very hard, with a lot of pain and frustration, when I first started out. I was very motivated. I wanted to achieve financial freedom, spend more time with my family and relatives, buy the car of my dreams, and travel the world.

I thought that trading was hard. I thought that to be a successful trader, I had to find the secret, or discover some mathematical formula that moves the markets.I used complicated indicators. I got excited about each new method I discovered, but as system after system failed, and all I came to expect was losses, my initial motivation to make money soon turned to real frustration and anger.

I spent four years like a hamster on a wheel, switching from one strategy to the other, from this trading robot to that other one without any results.And instead of achieving my financial freedom, I found myself without a social life, spending my spare time staring at my screens instead of spending time with my family.

I have wiped out seven trading accounts and lost thousands of dollars. I was on the path to giving up trading before I realized that everything that I was working so hard for, was right there in front of me the whole time.

Luckily, this will not be the case with you, because what I am going to share with you today will save you thousands of dollars and years of frustration.By which time, you too would come to the same realization I had–that all you need is a simple trading method to make money trading any financial market.

Why the Candlestick Trading Bible is the Simplest Method Ever?

The Candlestick Trading Bible is based on the T.L.S. method, which is one of the most important principles in the Candlestick Trading Bible approach.The T.L.S. method stands for Trend, Level, and Signal. In other words, when you open your charts, you will look for three important elements:

The trend: you will identify the market trend, and decide whether it is an uptrend, a downtrend, or ranging.

The level: you will find the key levels in the market, which can be support and resistance, trendlines, supply and demand zones …

The signal: you will identify a price action signal such as a pin bar, inside bar, or an engulfing bar…

When you have all three of these simple elements in alignment, then you have the perfect trading opportunity.

Look at the chart example below to see how you can find high probability setups using the T.L.S. trading method.

As you can see, you don’t need a magic indicator to make a profitable trading decision. What you need is to find three important elements:

In the chart above, the trend is up. This means that you will look to buy in the market. the level is the support area, and the signal is an inside bar setup. One or two trades a week like this is quite enough to make a good monthly income.

Look at how you can enter and exit this trade in the chart below:

As you can see the formation of the inside bar setup is a powerful signal to enter the market. The inside bar formation means that the market is consolidating. The breakout of the pattern means that the market decided to continue in the same direction. What you must do to make money is to follow the market direction.

Your entry is going to be the breakout point, and your stop loss is going to be placed under the tail of the mother candle, which is the larger candle before the inside bar, and the profit target is the next level. Easy, right?

The second concept that characterizes the Candlestick Trading Bible is trading with confluence, which means that you will learn how to find confluent factors that support your trading decisions. This will help you take only high-probability setups in the market and ignore low-quality ones.

Look at the chart below to understand how we make trades based on confluence:

The chart above shows how trading with confluence can lead us to identify setups with more than a 98% success rate. As you can see in the chart above, there are five factors of confluence that support our decision.

The first factor is the downtrend, which is a powerful signal to sell the market. Don’t ever try to buy a market in a downtrend. Most successful traders say “the trend is your friend” and this is exactly what I teach in the Candlestick Trading Bible.

The second factor is the level at which a support level becomes a resistance level. This area is the best place for you to wait for a price action signal to form.

The third factor is the pin bar candlestick that forms after the retracement back to the resistance level. It indicates that the retracement phase is over, and that the beginning of an impulse move is going to happen.

The fourth confluence factor is the 21-period simple moving average that acts as a dynamic resistance level and rejects the pin bar signal.

The last factor of confluence is the 50% and 61% Fibonacci retracement levels. These Fibonacci levels are considered to be the most powerful levels in the market.

If you think in terms of confluence as I teach in my Candlestick Trading Bible, you will develop a winning trading mindset, and your brain will get used to identifying only high-probability setups that lead to big profits.

Look at the same chart below to see how many pips you can get just by applying these concepts:

As you can see the market goes down 122 pips, because all the factors say that the market will go down. Imagine that you were in this trade using my Candlestick Trading Bible approach, and you decided to risk 10 dollars for every pip. You would have easily made $1220 in this trade!

What I share with you here represents just 1% of what you can learn from the Candlestick Trading Bible, which is considered to be the most powerful price action trading method in history. Remember that this method was used by Munehisa Homma, the god of markets in his day.

How the Candlestick Trading Bible Will Allow You to Overcome Fear and Trade with Emotional Control

According to statistics, 95% of traders lose money in the market. This is because our human psychology is not designed for trading. Our social conditioning teaches us that losing is not a good thing. We don’t like to lose, even when we are playing games. Our ego doesn’t accept losing and wants always to be right.

When we come to the trading environment, we try to act the same way we do in our social life. Let me give you an example. You make a trade. The market tells you that you are wrong. Your ego doesn’t accept that. When the market approaches your stop loss, you act immediately to change the placement, and you keep fighting the market till you wipe out your entire account. This is the reason why most traders lose money in the market.

The Candlestick trading Bible is based on a strict money management strategy that will allow you to trade in control of your emotions and join the 5% of successful traders. If you follow this money management strategy, you will never be a loser in the long run.

60 Days full money back guarantee

If for some weird reason at any time within the next 60 days you are not fully satisfied with the Candlestick trading bible , simply contact me at [email protected] I will refund your order in FULL because I want you to feel safe.All the risk is on me. You can give it an honest try for full 60 days with no questions,no hassles and no headaches.

Why am i giving 60 Days Full Money Back Guarantee?

I’m so confident you’ll absolutely love this trading system that I’m willing to bet on it with my full 60 Day money back guarantee. How can i be so sure? Well,i was using this trading approach for years, and i’am a big believer that this trading system can turn normal people to profitable traders.

Again, if you decide that for some weird reason, this trading method is not for you, then let me know and i will refund all your money back with no questions asked. Basically, i’am not happy to accept your money unless you are completely satisfied with this amazing price action trading approach.So there is zero risk – You simply CANNOT LOSE here…

The Ebook costs $47, it will be available for instant download after payment

0 notes

Text

Drugged Up

Last fall, we laid out the foundation for the current rally in pharmaceutical and biotech stocks; we take stock of those setups and the sectors’ present prospects.

Some may construe today’s post -- and the associated charts of the day – as a victory lap. And while there may be a hint of truth to that, such laps are inherent, at times, when using one’s track record for the purposes of teaching a lesson. In this case, the lesson has to do with objectively seeking opportunity in the midst of careening prices.

Baron Rothschild is the one most often credited with saying that "The time to buy is when there's blood in the streets.” Now, if you’re a longtime reader of our writings or are familiar with our investment philosophy, that quote probably does not come to mind when considering our investment selections. We are strong advocates of buying relative strength, i.e., those areas of the market that are performing best, not the bloodied ones. That said, there are times when we will wade into mean-reversion type plays because, as we have noted on plenty of occasions, most every falling knife can be caught at some point -- some just require more deftness than others, lest it be your own blood running in the streets.

For example, biotech and pharmaceutical stocks are currently among the darlings of Wall Street. However, folks may forget that if we rewind to last fall, they were the whipping boys. However, in the midst of their bloodbaths then, we were able to identify some objective levels on their charts which we felt had a good chance to stop the bleeding. Indeed, those levels set the foundation for the rallies currently at hand.

Pharma

Looking first at pharmaceutical stocks, we revisit one of our favorite, under the radar charts of 2016. Not only was the aftermath a smashing success, but the pieces of analysis fit together so well that it produced one of our highest confidence mean reversion setups of the year.

On November 23 of last year, the NYSE ARCA Pharmaceutical Index (DRG) was in free fall, down 25% from its 2015 all-time high, and down 17% in just the past 3 months. It was, however, hitting a compelling confluence of potential support near the 458 area. Among the key levels in that vicinity were:

The 38.2% Fibonacci Retracement of the 2009-2015 Rally ~458

The 61.8% Fibonacci Retracement of the Rally from the 2013 Breakout (above 2007 highs) to the 2015 top ~461

The 2000 former all-time high in the DRG that had held until the 2013 breakout

As we stated in that November post:

“We have been watching this level for a long time as a potential fulcrum, or pivot spot for the DRG, and, perhaps, the health care sector.”

We continued:

“This morning, the DRG fell 2%, bottoming at 459, before bouncing all the way back to close unchanged. This area should at least serve to stop the immediate bleeding in pharma stocks, and perhaps spur a reversal in the health care sector in general.”

Believe me when I say that trade setups do not always work as exquisitely as this one. But 2 weeks later, on December 7, the DRG hit an ultimate low of 458.39 before launching the rally that, as of earlier this week, had gained as much as 20%.

Biotech

This setup was not as intricate as that of the DRG, but it was effective nonetheless. Like the drug stocks, the biotech sector was also in a shambles last fall. In fact, it was arguably in worse shape after imploding in a potential bubble top in 2015. By early 2016, the NYSE ARCA Biotechnology Index (BTK) had lost over 40% of its value.

One of the few positives was that at both the early 2016 lows and the Brexit lows, the BTK had held its post-2009 Up trendline that connected the 2011 lows. On October 14, we wrote a post noting that the index was once again testing the trendline, near the 3000 level at the time. Additionally, the BTK was also testing the topside of its Down trendline from its 2015 peak, which it had broken above in late July.

In our view, the test of the intersection of these 2 key trendlines was enough to warrant consideration in dipping one’s toes into this bloodied sector. As we stated in the October post:

This convergence of trendlines should provide for staunch support in the BTK and biotech stocks – at least in the short-term.

As it happens, the BTK held this 3000 level for a few weeks. In late October, apparently in the fog of a potential presidential election victory by biotech foe Hilary Clinton, the BTK temporarily broke down. However, the index would only spend a few days below that key level before reclaiming it immediately following the election.

As with many false breakdowns, the recovery of the key 3000 level served as a springboard to the ensuing rally that, as of the past few days, has gained as much as 34%.

So what are the prospects for these sectors now following their respective impressive rallies? If one was lucky enough to buy the blood in the streets last fall, should they take the money and run? Or, given the health care sector’s recent breakout to all-time highs (which we documented last week), is this perhaps the beginning of a larger move?

In a premium post at The Lyons Share, we answer those questions (quite clearly). For our Tumblr/YahooFinance readers, we will reiterate today’s lesson. When encountering a market segment that has been bruised and battered -- and better yet, wholly dismissed by investors in hysterical fashion -- remember to stay objective. When the blood is in the streets, look for MAJOR chart levels with the potential to stop the bleeding. You just may spot the next biotech or pharma-like stars of tomorrow -- today.

If you want the “all-access” version of our charts and research, we invite you to check out our new site, The Lyons Share.

_____________

Disclaimer: JLFMI’s actual investment decisions are based on our proprietary models. The conclusions based on the study in this letter may or may not be consistent with JLFMI’s actual investment posture at any given time. Additionally, the commentary provided here is for informational purposes only and should not be taken as a recommendation to invest in any specific securities or according to any specific methodologies. Proper due diligence should be performed before investing in any investment vehicle. There is a risk of loss involved in all investments.

2 notes

·

View notes

Text

In Consolidation Mode, Bitcoin Awaits Decisive Move

Bitcoin has been restricted to a narrow price range of $10,000 to $11,000 for almost 72 hours.

CoinDesk’s Bitcoin Price Index (BPI) moved above the $10,000 mark on Monday, but the rally from last Sunday’s low of $9,304.68 ceased at a seven-day high of $11,044.16 yesterday. At the time of writing, the BPI is at $11,583.

The cryptocurrency has depreciated by 1.4 percent in the last 24 hours, according to data from CoinMarketCap. Further, it ended last month on a flat note, and is reporting a 1 percent gain on a weekly basis.

Notably, average daily trading volume dropped 38 percent in February, adding credence to bitcoin developer Meni Rosenfeld’s view that the craze for buying cryptocurrencies, in general, has calmed down.

That said, trading activity could pick up if the pace of bitcoin (BTC) sees an inverse head-and-shoulders breakout. However, technical charts also indicate scope for a big sell-off if BTC dips below the lows seen over the weekend.

Bullish scenario: inverse head-and-shoulders breakout

The descending trendline resistance and the inverse head-and-shoulders neckline are shown to converge at $11,640 by Saturday.

A high volume break (UTC lose) above $11,640 would signal long-term bull market revival and could open up towards $17,000-$17,400.

Bearish scenario I: BTC drops below $9,280

BTC could drop to point D ($6,659), as indicated by the bat pattern (harmonic pattern), if yesterday’s inverted bearish hammer candle on the downward sloping 50-day moving average is followed by a break below $9,324.75 (Feb. 25 low), today or in the next few days.

As per rules, the leg BC could go as high as $11,502 – 88.6 percent Fibonacci retracement of leg AB. Only a move above $11,502 would invalidate the bat pattern.

Note that point D is a “bullish reversal” according to bat pattern rules, meaning BTC will likely witness a sharp rebound from $6,659.

Bearish scenario II

Another possibility is that BTC moves above $11,502, but faces rejection at the confluence of inverse head-and-shoulders neckline resistance and descending trendline resistance

Failure to take out the confluence of resistance at $11,640, followed by a quick drop below $9280.4, could yield a sell-off to $6,000 (February low).

Source www.coindesk.com

The post In Consolidation Mode, Bitcoin Awaits Decisive Move appeared first on Bitcoin Geek.

via Kingmind In Consolidation Mode, Bitcoin Awaits Decisive Move

0 notes

Text

New Post has been published on Forex Blog | Free Forex Tips | Forex News

!!! CLICK HERE TO READ MORE !!! http://www.forextutor.net/silver-technical-analysis-prices-pressing-resistance-2017-highs/

Silver Technical Analysis: Prices Pressing Resistance / 2017 Highs

Silver prices have continued to struggle at a key Fibonacci confluence at 18.33/39 where the 100% extension of the December advance converges on the 50% retracement of the decline off the 2016 high. Keep in mind that this region is also defined by the 2017 yearly opening-range highs and if compromised, would reinforce the broader bullish outlook.

Chart 1: Silver Daily Timeframe (June 2016 to April 2017)

The precious metal continues to trade within the confines of an ascending pitchfork formation extending off the November / December lows with the median-line offering support this week. An outside-day reversal candle today at the highs may be an indication of near-term exhaustion for the silver rally heading into the close of the week, but the broader focus remains weighted to the topside while within this formation.

Chart 2: Silver 4-hour Timeframe (March 17 to April 7, 2017)

A closer look at price action highlights ongoing momentum divergence into these highs with price attempting to breach the February highs earlier today. We’d need to see a weekly close above this threshold to validate a breakout with the immediate long-bias at risk while below. A break below the 200-day moving average / May high at 18.00/04 would be needed to mark a near-term correction lower in prices. That said, a breach above this threshold targeting subsequent topside targets at 18.58/60 backed by the key 61.8% retracement at 19.02. Note that both the daily & intraday momentum profiles remain constructive for now & we’ll be looking for a marked break sub-50 to suggest a more meaningful turn is underway.

— Written by Michael Boutros, Currency Strategist with DailyFX

Silver Technical Analysis: Prices Pressing Resistance / 2017 Highs Silver Technical Analysis: Prices Pressing Resistance / 2017 Highs https://rss.dailyfx.com/feeds/technical_analysis $inline_image

0 notes

Text

Bitcoin Poised to Retest $5,000 Before Return to Bull; Here’s Why Analysts Think So

Earlier this month, the one-week Bitcoin chart printed an extremely bullish sign: the golden cross of the 50-week and 100-week simple moving averages, with the former crossing above the latter. (As an aside, a golden cross is when a short-term moving average crosses over a long-term one to imply bulls have control.)

Related Reading: Bitcoin Poised to Collapse Under $5,000? Market Cycle Fractal Suggests So

While this is a decidedly bullish sign in the long term, with this signal preceding the 1,000%+ rally seen between 2016 and the end of 2017, a number of leading analysts have remarked that Bitcoin is still susceptible to one final downturn before an eventual return to the macro uptrend.

Bitcoin Poised to Return to $5,000 Before Breakout

Former Wall Street trader turned Bitcoin analyst Tone Vays recently sat down with BlockTV, an industry media outlet, to talk his price outlook for the cryptocurrency market heading into 2020.

While Vays has started to show signs of optimism, he remarked that he still expects for BTC to see the “next low to come in [during] the first quarter of 2020.” As to where this low in the cryptocurrency market will come in, the long-time cryptocurrency trader looked to the $5,000s, claiming that there’s a high probability Bitcoin will enter that range to put in a fresh low.

(While the trader is currently short-term bearish, he remarked in another interview with BlockTV that he thinks Bitcoin could hit $50,000 by 2023.)

#WEEKINREVIEW: "I think we could have a little bit of a rally into the close, but I'm not really expecting anything above $8,000 any time soon. I'm looking for the next low to come in in the first quarter of 2020." – @ToneVays.

See Tone's full analysis: https://t.co/jhKiJ3gUWw pic.twitter.com/Wiz3A3irND

— BLOCKTV (@BLOCKTVnews) December 27, 2019

Vays Isn’t Alone In Saying So

It isn’t only Vays that is eyeing the $5,000s as a potential final bottom for Bitcoin before a return to a bull phase.

CryptoBirb, a strong proponent of the positive effects the aforementioned golden cross will have, recently noted that Bitcoin still has the potential to see one final dump to $5,400-$5,600 — 23% lower than the current price of $7,150. This coincides with the long-term 0.786 Fibonacci Retracement level.

This was echoed nearly exactly by both BitcoinEconomics and Jacob Canfield, who recently looked to the sentiment that BTC is likely going to see one more shakeout prior to a return to the bull trend.

There’s also a simple observation from trader Mac, who remarked that the low-$5,000s will be a macro bottom for Bitcoin due to a confluence of technical levels in that region: the double-month volume-weighted average price, a “price inefficiency fill” level, and the 200-week moving average.

Featured Image from Shutterstock

The post Bitcoin Poised to Retest $5,000 Before Return to Bull; Here’s Why Analysts Think So appeared first on NewsBTC.

from Cryptocracken WP https://ift.tt/39mkZWz via IFTTT

0 notes